Location & Lifestyle Matter When Buying A Home

Finding Your Happy Place: How Picking the Perfect Spot Can Make or Break Your Home Sweet Home!

Thinking about buying a home? Well, it’s not just about the looks and likes! Picture this: the kind of life you dream about when you’re sipping on your morning coffee or winding down after a hectic day. That’s what should be guiding your hunt for the perfect pad. Where you plant your roots can turn the everyday blah into everyday ta-dah! Let’s dive into this little adventure and discover how zeroing in on the life you fancy can lead you to the doorstep of your ideal home sweet home.

The Influence of Location on Lifestyle

1. Transportation and Ease of Access: The journey to and from your workplace every day is a considerable factor that influences your overall well-being. Would you prefer a brief, comfortable trip to the office or is the allure of a countryside lifestyle worth a longer commute for you? Being situated near your job, educational institutions, and key amenities can be a great convenience, potentially saving you precious time and helping to minimize daily tension.

Some walkable areas in Richmond, VA include Downtown, The Fan, Museum District, Carytown, Scotts Addition, and Church Hill.

2. City, Town or Country Living: Reflect on your preferred setting, whether it’s the vibrant life in a city, the serene surroundings of a town, or the quiet expanse of the countryside. Every location presents a unique way of life. Cities boast easy access to museums, theaters, and a diverse job market, though they might also mean a steeper cost of living. Towns typically strike a harmonious compromise, offering accessibility with a touch of peacefulness, whereas country living is synonymous with serenity and the splendor of nature.

Even if you do not prefer city life, Richmond’s suburban areas offer a plethora of dining and entertainment options. Places like Short Pump and Midlothian cater to both young professionals and families.

3. Leisure Pursuits and Hobbies: Which pastimes and leisure activities bring you pleasure? For those who revel in the great outdoors, being close to green spaces, pathways for hiking, or bodies of water could be significant. On the other hand, those who prefer urban living might place a higher value on the convenience of nearby theaters, diverse dining options, and vibrant night scenes.

If you are moving to Richmond, VA or considering a new neighborhood, you are in luck! Most Richmond areas have great outdoor options, such as parks, trails, and bodies of water, like the James River.

4. Community and Social Life: Seeking to establish a strong sense of community? Various neighborhoods are known for their close-knit communities and closeness, and others prioritizing privacy and independence. Your social preferences matter when choosing the right neighborhood for you.

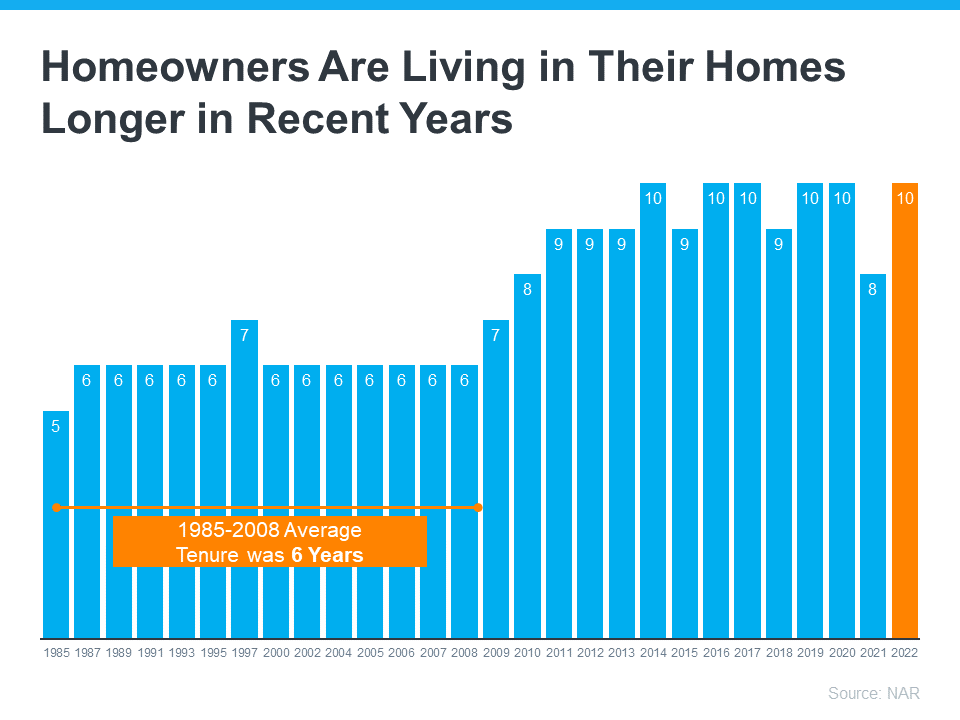

5. Future Planning: Consider your future aspirations. Do you plan on starting a family, working remotely, or preparing for retirement? Your lifestyle should match your long-term goals. For instance, families may value quality schools and safe neighborhoods.

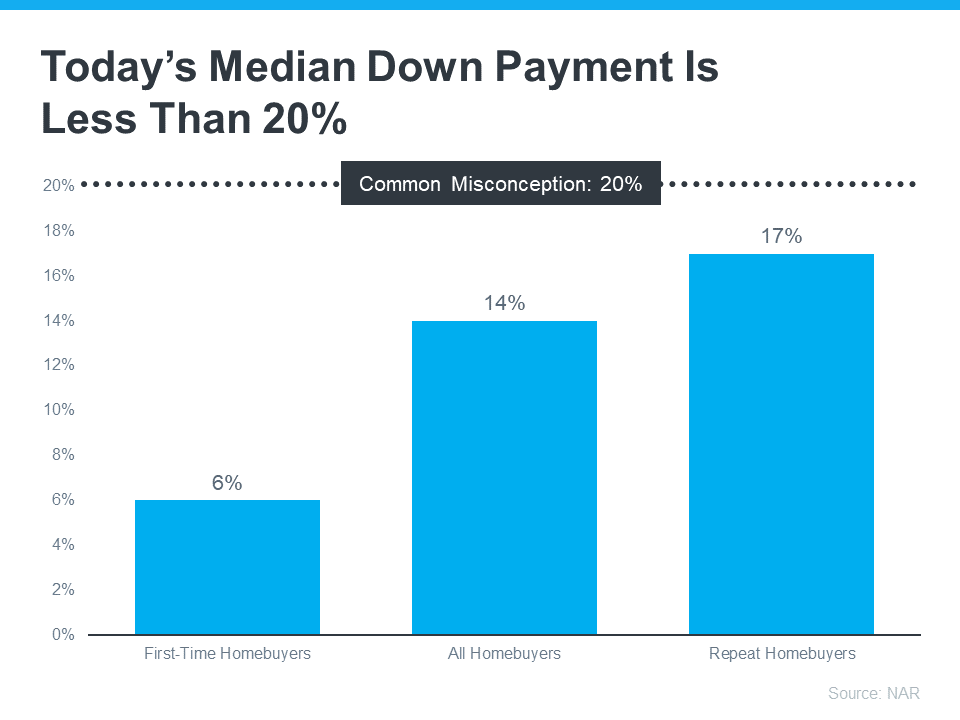

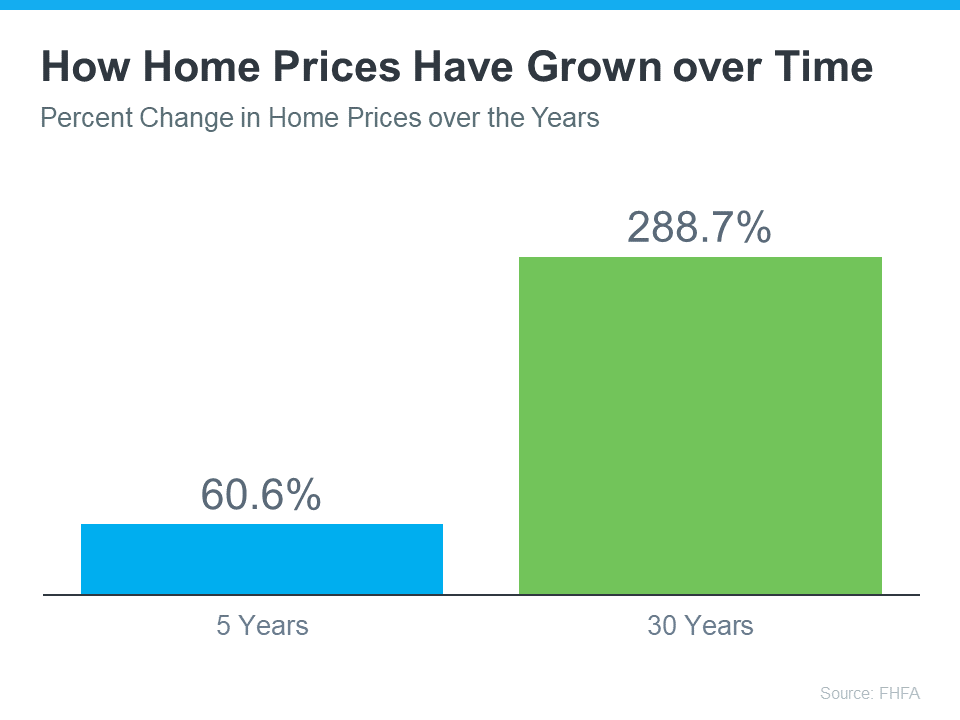

6. Costs of Living and Financial Goals: Consider the costs of living with different lifestyles. Urban living can be pricier than rural living. Keep your budget and financial goals in mind when deciding.

Simply put, when purchasing a property, it’s important to consider how the location aligns with the lifestyle you desire. Reflect on your priorities, needs, and future plans to find a home that not only meets your physical requirements but also enhances your daily life and well-being.

![Why Buying a Home May Make More Sense Than Renting [INFOGRAPHIC] | MyKCM](https://files.mykcm.com/2022/09/29141015/20220930-MEM-1046x1845.png)